Residual Income Valuation Notes & Practice Questions CFA

The next section of this article will discuss more about each one. This receipt is called a debit voucher because it supports the entries on the debit side of the cash book. For every entry recorded in the cash book, there must be a proper voucher.

What is an analytical petty cash book?

The letter “C” indicates that the contra effect of this transaction is recorded on the opposite side. Yes, the app provides the functionality to export data into Excel and PDF formats, facilitating easy data analysis and sharing. The development team behind CashBook clearly prioritizes user feedback, as evidenced by ongoing updates that refine and introduce features based on user suggestions.

Example of a Simple Petty Cash Book

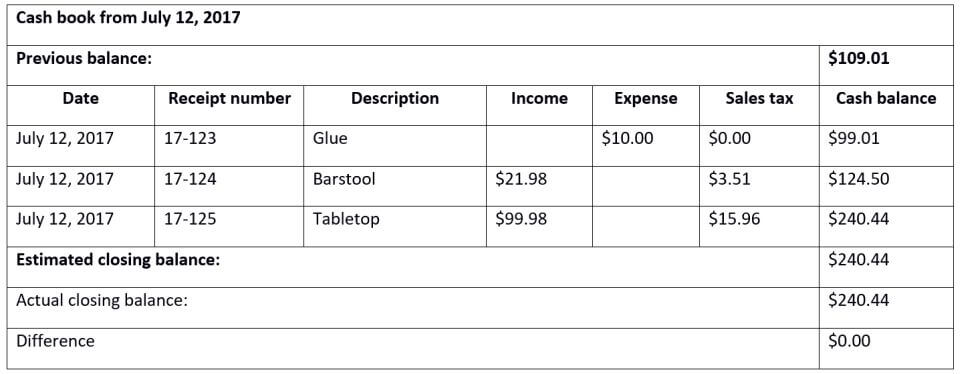

Businesses may use a cash book to track their income and expenses. Cash books come in a single column and can have an additional column. Under a single column cash book, only cash transactions are done by the business record. It contains debits and credits which are double-entry Bookkeeping entries. Debits represent increases of value or asset accounts while credits represent decreases in value or liability accounts.

What is the approximate value of your cash savings and other investments?

- It also encourages sharing and collaboration, essential aspects for groups and businesses requiring transparent and collective oversight of financial activities.

- A cash book with three columns for discounts received and paid, cash transactions, and bank transactions is known as a three column cash book.

- This comprehensive format includes additional columns specifically for discounts and tax amounts, enabling detailed tracking of financial activities.

- When a payment is made, an original receipt is obtained from the payee.

- A bank account may have an overdrawn balance because by arranging an overdraft with the bank, it is possible that more money may be withdrawn from the bank than what was deposited.

It also encourages sharing and collaboration, essential aspects for groups and businesses requiring transparent and collective oversight of financial activities. When an account holder deposits money with the bank, the bank’s liability to the account holder is increased from the bank’s point of view. During the month of January 2022 following transactions took place in David’s business. Dealers collect VAT on their sales, retain the tax paid on their purchases. Thus, the difference between the VAT received and VAT paid is calculated. With this Cash Book Template, you can efficiently and easily record the daily transactions with VAT.

This type is commonly used by individuals who want to keep track of their own money and finances. To use the single-column version of the cash book, transactions are noted in one column. The two column cash ledger book is sometimes referred to as the double column cash book or the 2 column cash book. Again, for simplicity, the two column cashbook ledger diagram below shows only one side of the cashbook, in this case the left hand receipts side (debit).

When a petty cashier needs money, the main cashier gives them a cheque. This cheque is recorded on the payments side of the main Cash Book. Record the following transactions in a simple petty cash book for the month of January 2019. As a matter of practice, banks send a list of entries to each account holder that have been made in their personal account, which is maintained by the bank. Most businesses ask for their bank statement at the end of each month.

Therefore, the bank credits the account holder’s personal account, and the entry appears in the Cr. An original entry in a cash book is a record of a financial transaction. All of this information is very important for accounting and tax records. It is essential for businesses to keep track of their finances in order to stay compliant with the law. A passbook, on the other hand, is typically kept by the bank and provided to the customer.

This is to show you how easy it is to keep a spreadsheet to track the money. Exact measurements are not a requirement for keeping a cash book spreadsheet. Use these cash book format understanding your tax forms instructions to make your very own cashbook spreadsheet using plain paper or a school exercise book. First, the opening and closing balances of the cash book are not posted.

Jami has collaborated with clients large and small in the technology, financial, and post-secondary fields. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. For this purpose, he is given a small amount and a separate book to record these small payments. The last line consists of totals of the amount and a discount column for ready reference. The first row is for the company name and second for the title of the template. The Cash on Hand balance amount is displayed on the right-hand side.

Related Posts

Double-entry Bookkeeping What is Bookkeeping

Realization Principle Definition, Example, How it Works?

Categories

- ! Без рубрики

- ++PU

- 1

- 100_2

- 10150_tr2

- 10310_tr

- 10450_wa

- 10520_wa

- 10550_wa

- 10750_wa

- 11075_tr

- 11275_ru

- 1w

- 1Win AZ Casino

- 1Win Brasil

- 1win Brazil

- 1win casino spanish

- 1win fr

- 1win India

- 1WIN Official In Russia

- 1win Turkiye

- 1win uzbekistan

- 1winRussia

- 1xbet apk

- 1xbet arabic

- 1xbet Casino AZ

- 1xbet casino BD

- 1xbet casino french

- 1xbet egypt

- 1xbet india

- 1xbet Korea

- 1xbet KR

- 1xbet malaysia

- 1xbet Morocco

- 1xBet promo

- 1xBet promocodes

- 1xbet pt

- 1xbet RU

- 1xbet russia

- 1xbet Russian

- 1xbet russian1

- 2

- 22bet

- 22Bet BD

- 22bet IT

- 6570_ru

- 6900_tr

- 7375_ru

- 7430_tr

- 7620_ru

- 8000_ru

- 8000_wa

- 8040_ru

- 8100_wa

- 8150_wa

- 8300_wa

- 8435_wa

- 8746_wa

- 8900_tr

- 8990_wa

- 9000_wa

- 9000_wa2

- 9020_wa

- 9065_tr

- 9090_wa

- 9100_wa

- 9150_wa

- 9200_wa

- 9300_wa

- 9350_wa

- 9380_wa

- 9400_wa

- 9670_wa

- 9700_wa

- 9780_wa

- 9800_wa

- 9820_wa

- 9860_wa

- 9900_wa

- 9925_wa

- AI News

- Artificial intelligence

- Artificial intelligence (AI)

- Arts & Entertainment, Music

- asian brides

- asian mail order bride

- Aviator

- aviator brazil

- aviator casino DE

- aviator casino fr

- aviator IN

- aviator ke

- aviator mz

- aviator ng

- b1bet BR

- b1bet brazil

- Bahis sitesi

- Bahsegel

- Bahsegel giris

- Banda

- Bankobet

- Basaribet

- bbrbet colombia

- bbrbet mx

- best dating reviews

- best dating sites

- best dating sites for over 40

- best mail order bride sites

- best mail order brides sites

- Betpas_next

- Bettilt

- Bettilt_new

- Betzula

- bh_sep

- big bass de

- bizzo casino

- blackjack-deluxe

- Blog

- book of ra

- book of ra it

- Bookkeeping

- Bootcamp de programação

- Bootcamp de programación

- brides

- bt_sep

- BT+

- btbtnov

- bttopjan

- Business

- Business, Article Marketing

- casibom tr

- casino

- casino en ligne

- casino en ligne fr

- casino onlina ca

- casino online ar

- casinò online it

- casino utan svensk licens

- casino-glory india

- casinom-hub.comsitesi apr

- casinomaxi

- casinomhub_may

- casinos

- catonvillage.org.uk

- chinese dating

- chinese mail order brides

- chjan

- CHjun

- colombian mail order bride sites

- cosmetology school toronto

- Counter Strike 2

- crazy time

- Cryptocurrency News

- Cryptocurrency service

- csdino

- dating japanese women

- dating online

- dating reviews

- dating sites

- dating sites guide

- dating sites review

- dating women online

- diabete

- dj tools reviews

- Dumanbet_next

- ed

- Education

- en

- Fair Go Casino

- fi

- filipino women

- Finance, Credit

- Finance, Investing

- find a bride

- find a bride online

- find a wife

- find a wife online

- find beautiful wome

- FinTech

- Forex ENG

- Forex Trading

- fortune tiger brazil

- fr

- Galabet

- Gama Casino

- german mail order bride

- gewichtsverlies

- glory-casinos tr

- hayatnotlari com

- Health & Fitness, Alternative Medicine

- Health & Fitness, Diabetes

- hello world

- heylink.memostbet-giris_may

- Hitbet

- Imajbet

- Internet Business, Web Design

- IT Education

- IT Vacancies

- IT Вакансії

- IT Образование

- IT Освіта

- ivermectine

- japanese mail order wife

- japanese women

- JetX

- Jojobet

- KaravanBet Casino

- Kasyno Online PL

- king johnnie

- korean mail order brides

- L

- latin brides

- latin mail order brides

- latin women for marriage

- Law

- levitra

- LuckyJet

- mail order bride

- mail order bride review

- mail order brides

- mail order brides catalogue

- Maribet casino TR

- Marketing

- Marsbahisgiris

- MarsMaksBahis

- Masalbet

- medbrat

- melhor cassinos online

- Monobrand

- mostbet

- mostbet azerbaijan

- Mostbet Casino AZ

- mostbet hungary

- mostbet italy

- mostbet norway

- mostbet ozbekistonda

- mostbet tr

- Mostbet UZ Kirish

- mostbet-ru-serg

- Mr Bet casino DE

- mr jack bet brazil

- mx-bbrbet-casino

- News

- nl

- NonGamStopUK

- Office

- online casino au

- online dating

- onlone casino ES

- ozempic

- ozwin au casino

- PB

- PB_TOP

- pbnov

- pbtopjan

- pelican casino PL

- Pin UP

- Pin Up Brazil

- pin up casino

- Pin UP Casino AZ

- Pin Up Peru

- pinco

- PinUP AZ Casino

- plinko

- plinko in

- plinko UK

- plinko_pl

- polish brides

- potency

- Pozyczki

- pujan

- punov

- Qizilbilet

- Ramenbet

- Recreation & Sports, Fishing

- Reference & Education, Sociology

- Review

- ricky casino australia

- Roku

- russian mail order brides

- rybelsus

- se

- slot

- Slots

- slottica

- slugwatch

- Sober living

- Society, Divorce

- Society, Relationships

- Society, Sexuality

- Software development

- Sweet Bonanza

- sweet bonanza TR

- test content

- thai women

- top dating sites

- Top Online Casino

- troikaeditions.co.uk

- Uncategorized

- upsi.org.uk

- verde casino hungary

- verde casino poland

- verde casino romania

- vietnamese brides

- Vovan Casino

- vulkan vegas DE login

- vulkan vegas germany

- wife finder

- women features

- women for marriage

- Youwin

- Весільні та Вечірні Сукні

- водка

- Казино

- Комета Казино

- Криптовалюты

- Микрокредит

- Пачка Ru

- Рейтинг Казино

- Финтех

- Форекс Брокеры

- Форекс Обучение

- Швеция