Deferred Rent for ASC 842 Explained w Examples, Entries

One such ratio is the accounts receivable turnover ratio, which measures how efficiently a company collects its receivables. A higher turnover ratio indicates that the company is effective in collecting rent, translating to better cash flow and reduced risk of bad debts. Conversely, a lower ratio may signal collection issues, necessitating a review of credit policies and collection procedures. Managing rent receivables effectively requires more than just basic tracking and collection methods.

Journal Entry for Rent received in Advance

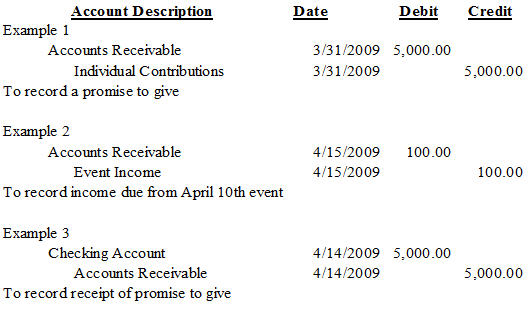

To record accrued rent receivable, a property owner would make a journal entry at the end of the accounting period debiting the accrued rent receivable account and crediting the rent revenue account. Once the rent is received, the property owner would reverse the receivable and increase the cash account with a corresponding journal entry. Setting up receivable accounts is an integral component of using an accrual method of accounting. In a rental property situation, you earn the rental income on each date that the lease agreement requires the tenant to make payment. Under the accrual basis of accounting, rent revenue is recognized when it is earned, not necessarily when cash is received.

- On April 1, you will post a debit entry to the rent receivable account for $800 and post a corresponding credit entry to the rental revenue account for the same amount.

- Here is the journal entry at transition – showing the debit to accrued rent to remove the balance from a separate account and credit to the ROU asset to adjust the beginning balance.

- These agreements outline the terms under which rent is to be paid, including the amount, due dates, and any conditions that might affect payment.

- This helps to ensure that the company is accurately tracking its income and expenses.

Accounting and Journal Entry for Rent Paid

The Landlord agrees to provide a $200,000 tenant improvement allowance to be paid upfront at the commencement of the lease. Rent Receivable is one of the highly liquid current assets against renting service provided. We need to replace the Debtors with Rent Receivable on the debit side of the Journal entry and Sales revenue with Rental revenue on the credit side of the Journal entry.

Management Override of Controls

This means that even if a tenant has not yet paid, the revenue is still recorded, providing a more accurate reflection of the company’s earnings during a specific period. This practice ensures that the income statement presents a true picture of the company’s operational performance, which is crucial for stakeholders making informed decisions. Over the entire lease term, total cash payments will equal the total expense incurred. If there are periods where the straight-line expense is greater than cash paid, deferred rent is recorded and accumulated, to be relieved later in the term.

Rent Receivable is an item which is recorded when a tenant has paid their rent but the amount has not yet been received by the landlord. Rent Receivable is an asset account and can be recorded in the books of the landlord as a debit entry. Here is the journal entry at transition – showing the debit to accrued rent to remove the balance from a separate account and credit to the ROU asset to adjust the beginning balance.

Other considerations in the rent expense measurement

Rent received in advance is shown under current liability in the balance sheet. Entities paying GST have to charge GST on the rental services provided by them to the tenants. Also, tenants who have rented the property or office premises have to deduct TDS on the rent amount payable to the landlord. It is shown on the credit side of an income statement (profit and loss account). In addition to timing, the nature of the rent receivable must be considered. This includes distinguishing between different types of rent, such as base rent, percentage rent, and additional charges like maintenance fees or utilities.

Instead accrued rent will now be reflected in the balance sheet as an adjustment to the newly capitalized ROU asset. At transition, any cumulative balances accrued for unpaid rent obligations will be reclassified to the opening balance of the appropriate lease’s ROU asset. On a net basis, the balance sheet will not be impacted by this journal entry. The accrued rent liability is reduced, but the ROU asset is also reduced by the same amount. What changed upon transition to ASC 842 is the requirement that lessees record operating leases on the balance sheet.

The debit to the rent receivable account increases the asset account, as the company has not received the payment from the customer. The credit to the rent revenue account increases the revenue account, as the company has earned the rent payment. The excess expense recorded over the total cash paid has been accrued or deferred until the cash payments are larger than the expense recognized and the accumulated liability is depleted to zero. When dealing with lease incentives, such as rent-free periods or tenant improvement allowances, the accounting treatment must reflect the economic substance of the transaction.

Rent Receivable is an asset (which has a default Debit balance), and Rental Income falls under the revenue group (with Credit balance). With expertise in federal taxation, law and accounting, he has published articles in various rent receivable journal entry online publications. Franco holds a Master of Business Administration in accounting and a Master of Science in taxation from Fordham University. Consider removing one of your current favorites in order to to add a new one.

Related Posts

Double-entry Bookkeeping What is Bookkeeping

Realization Principle Definition, Example, How it Works?

Categories

- ! Без рубрики

- ++PU

- 1

- 100_2

- 11275_ru

- 1w

- 1Win AZ Casino

- 1Win Brasil

- 1win Brazil

- 1win casino spanish

- 1win fr

- 1win India

- 1WIN Official In Russia

- 1win Turkiye

- 1win uzbekistan

- 1winRussia

- 1xbet apk

- 1xbet arabic

- 1xbet Casino AZ

- 1xbet casino BD

- 1xbet casino french

- 1xbet egypt

- 1xbet india

- 1xbet Korea

- 1xbet KR

- 1xbet malaysia

- 1xbet Morocco

- 1xbet pt

- 1xbet RU

- 1xbet russia

- 1xbet Russian

- 1xbet russian1

- 2

- 22bet

- 22Bet BD

- 22bet IT

- AI News

- Artificial intelligence

- Artificial intelligence (AI)

- Arts & Entertainment, Music

- asian brides

- asian mail order bride

- Aviator

- aviator brazil

- aviator casino DE

- aviator casino fr

- aviator IN

- aviator ke

- aviator mz

- aviator ng

- b1bet BR

- b1bet brazil

- Bahis sitesi

- Bahsegel

- Bahsegel giris

- Banda

- Bankobet

- Basaribet

- bbrbet colombia

- bbrbet mx

- best dating reviews

- best dating sites

- best dating sites for over 40

- best mail order bride sites

- best mail order brides sites

- Betpas_next

- Bettilt

- Bettilt_new

- Betzula

- bh_sep

- bizzo casino

- blackjack-deluxe

- Blog

- book of ra

- book of ra it

- Bookkeeping

- Bootcamp de programação

- Bootcamp de programación

- brides

- bt_sep

- BT+

- btbtnov

- Business

- Business, Article Marketing

- casibom tr

- casino

- casino en ligne

- casino en ligne fr

- casino onlina ca

- casino online ar

- casinò online it

- casino utan svensk licens

- casino-glory india

- casinom-hub.comsitesi apr

- casinomaxi

- casinomhub_may

- casinos

- chinese dating

- chinese mail order brides

- CHjun

- colombian mail order bride sites

- cosmetology school toronto

- Counter Strike 2

- crazy time

- Cryptocurrency News

- Cryptocurrency service

- csdino

- dating japanese women

- dating online

- dating reviews

- dating sites

- dating sites guide

- dating sites review

- dating women online

- diabete

- dj tools reviews

- Dumanbet_next

- ed

- Education

- en

- filipino women

- Finance, Credit

- Finance, Investing

- find a bride

- find a bride online

- find a wife

- find a wife online

- find beautiful wome

- FinTech

- Forex ENG

- Forex Trading

- fortune tiger brazil

- fr

- Galabet

- Gama Casino

- german mail order bride

- gewichtsverlies

- glory-casinos tr

- hayatnotlari com

- Health & Fitness, Alternative Medicine

- Health & Fitness, Diabetes

- hello world

- heylink.memostbet-giris_may

- Hitbet

- Imajbet

- Internet Business, Web Design

- IT Education

- IT Vacancies

- IT Вакансії

- IT Образование

- IT Освіта

- ivermectine

- japanese mail order wife

- japanese women

- JetX

- Jojobet

- KaravanBet Casino

- Kasyno Online PL

- king johnnie

- korean mail order brides

- latin brides

- latin mail order brides

- latin women for marriage

- Law

- levitra

- LuckyJet

- mail order bride

- mail order bride review

- mail order brides

- mail order brides catalogue

- Maribet casino TR

- Marketing

- Marsbahisgiris

- MarsMaksBahis

- Masalbet

- medbrat

- melhor cassinos online

- mostbet azerbaijan

- Mostbet Casino AZ

- mostbet hungary

- mostbet italy

- mostbet ozbekistonda

- mostbet tr

- Mostbet UZ Kirish

- mostbet-ru-serg

- Mr Bet casino DE

- mr jack bet brazil

- mx-bbrbet-casino

- News

- nl

- NonGamStopUK

- Office

- online casino au

- online dating

- onlone casino ES

- ozwin au casino

- PB_TOP

- pbnov

- pelican casino PL

- Pin Up Brazil

- pin up casino

- Pin UP Casino AZ

- Pin Up Peru

- pinco

- PinUP AZ Casino

- plinko

- plinko in

- plinko UK

- plinko_pl

- polish brides

- potency

- Pozyczki

- punov

- Qizilbilet

- Ramenbet

- Recreation & Sports, Fishing

- Reference & Education, Sociology

- ricky casino australia

- Roku

- russian mail order brides

- rybelsus

- se

- slot

- Sober living

- Society, Divorce

- Society, Relationships

- Society, Sexuality

- Software development

- Sweet Bonanza

- sweet bonanza TR

- test content

- thai women

- top dating sites

- Uncategorized

- verde casino hungary

- verde casino poland

- verde casino romania

- vietnamese brides

- Vovan Casino

- vulkan vegas DE login

- wife finder

- women features

- women for marriage

- Youwin

- Весільні та Вечірні Сукні

- водка

- Казино

- Комета Казино

- Криптовалюты

- Микрокредит

- Пачка Ru

- Финтех

- Форекс Брокеры

- Форекс Обучение

- Швеция